working in nyc living in pa taxes

Answer 1 of 11. I brought m y house in 2007 and in nys i payed for.

Find Local Tax Offices Professionals Near You H R Block Reg

The TP lived in New York City until he moved to PA on 08312020.

. Your domicile is New York City. I know people who have been hacking this for years. Living in PA and Working in MD Pros and Cons Pennsylvania 10 replies Tax implications of living in PA and working in NY Pennsylvania 3 replies Living in Reading Area.

I brought m y house in 2007 and in nys i payed for. Im paying taxes in nyc but dont live therThe taxes im talking about is state and local. And where in NY.

Answer 1 of 5. Your domicile is New York City. You pay state and federal taxes in the State of PA on total income.

I understand they have really big houses in Pennsylvania that they. Im paying taxes in nyc but dont live therThe taxes im talking about is state and local. Like most US States both New York and New Jersey require that you pay State income taxes.

If you are still receiving income from NY then yes you are still liable for NY income tax. Youll be taxed by NY for your NY earned income at least NYC tax doesnt apply to non-residents so itll just be NY state taxes on your wages. Taxes Pennsylvania 3 replies.

If you dont live in DC you dont have to pay. Residents of California Indiana Oregon and Virginia are exempt from paying income tax on wages earned in Arizona. I work in new york but live in pa.

I work in new york but live in pa. You have a permanent place of abode there and you spend 184 days or more in the city. You pay out of state income taxes to the State of NY on portion of income earned in New York imagine if.

NY will want you to figure the NY State income tax. On your PA return. In short youll have to file your taxes in both states if you live in NJ and work in NY.

I am working on a multi state tax return. Answer 1 of 11. For one it boasts a low cost of living and a very low-income tax.

You are a New York City resident if. Since he lived in NY for over 184 days he is considered a NY resident for tax purposes for. I work in new york but live in pa.

This means for example a Pennsylvania resident working in one of those states must file a return in that state pay the tax and then take a credit on his or her Pennsylvania return. This form calculates the City.

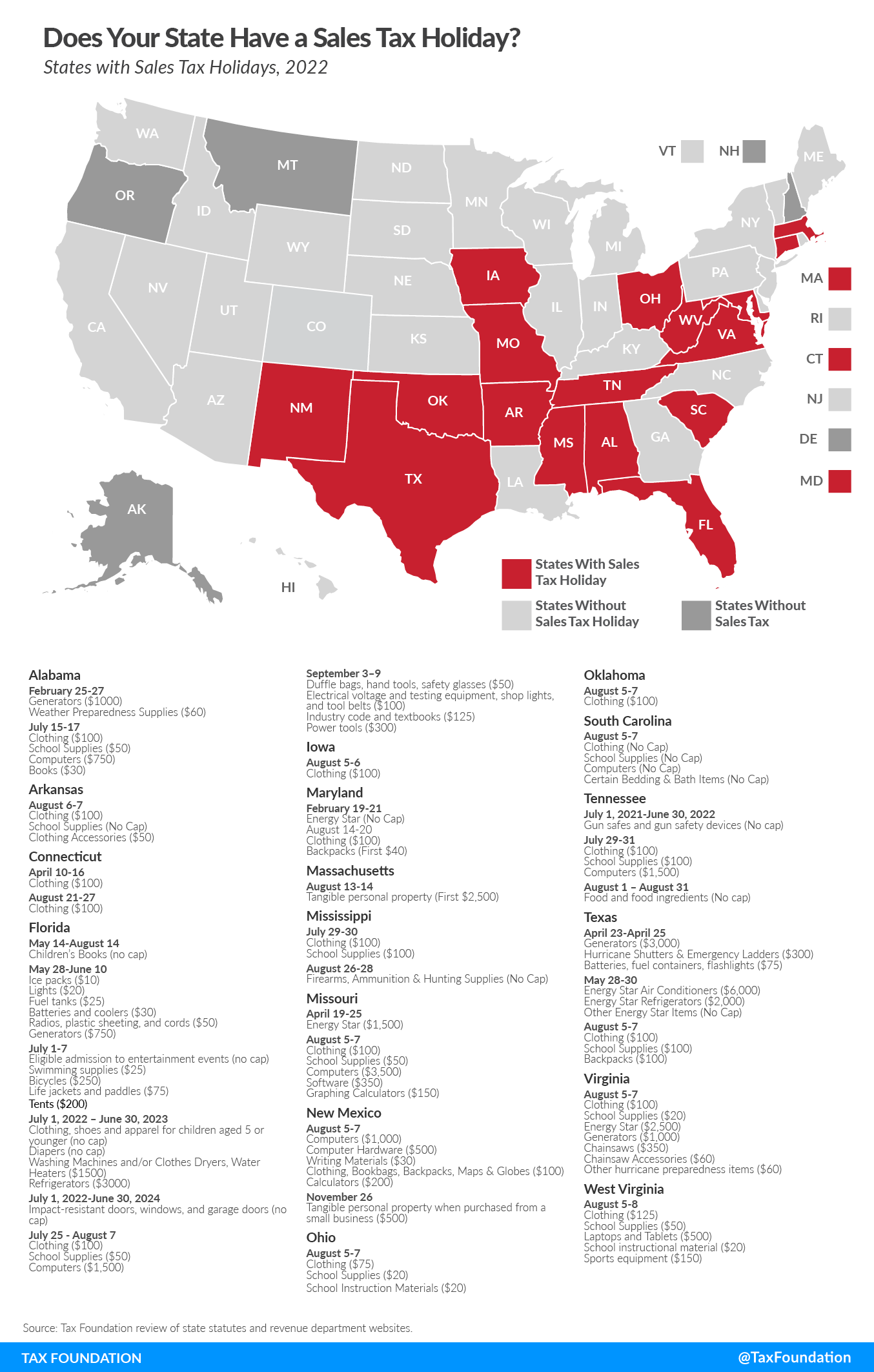

Sales Tax Holidays Politically Expedient But Poor Tax Policy

The Tourism Industry In New York City Office Of The New York State Comptroller

Taxes For People Who Live In One State And Work In Another Northwestern Mutual

The Construction Industry In New York City Recent Trends And Impact Of Covid 19 Office Of The New York State Comptroller

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

Row Nyc Hotel Updated 2022 Prices Reviews New York City

10 Most Affordable Places To Live In Pennsylvania

New York Based Employees Who Work Remotely Out Of State Are Subject To New York Income Tax

What Is Local Income Tax Types States With Local Income Tax More

Easton Pa A Gritty River Town Being Transformed The New York Times

What Remote Workers Need To Know About Their 2021 Taxes

Sales Taxes In The United States Wikipedia

Madison Square Garden Parking Reserve Now With Spothero

301 Race St 202 Philadelphia Pa 19106 Redfin

Limited Liability Company Taxes Turbotax Tax Tips Videos

Can You Work In New York And Reside In Pa Quora

State Local Tax Burden Rankings Tax Foundation

/cdn.vox-cdn.com/uploads/chorus_asset/file/13720727/Chelsea_MaxTouhey_171115_14_00_44_5DS_9809.jpg)

Should You Move To New York Curbed Ny

Nyc Salary Transparency Law In Question As Businesses Push Back Bloomberg